Realistic historical return of the Dow Jones

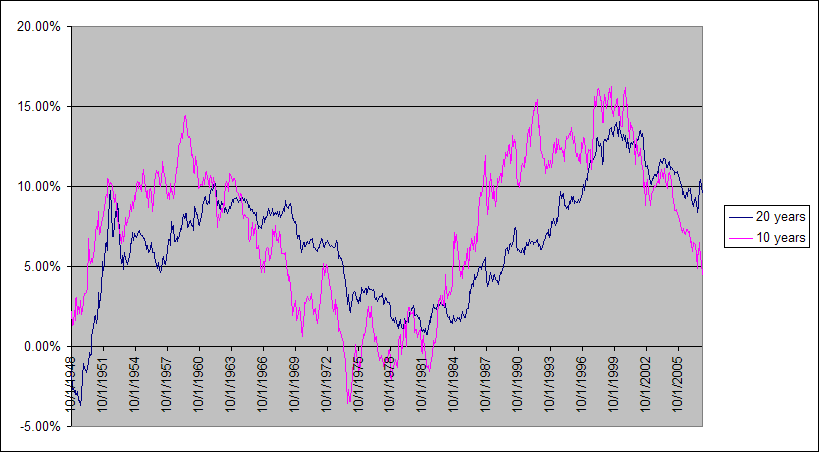

Though stock markets around the world have crashed, many will argue that the historical return of the DJIA is pretty good and we shouldn’t worry about one bad year. But they compute the average annual return for a far longer period than most investors will actually invest in the market. That is, computing the average over 50 years is silly since most investors are only invested for 10 or 20 years. The chart below shows the average annual return if you had bought and held the DJIA for 10 or 20 years. So if you bought it 20 years ago and sold this month, your annual return would be 9.5%. The chart demonstrates that those who sold in the 70s and 80s would have seen less than a 5% annual return. Factor in the ridiculous inflation rate and they actually lost money. So the very long-term historical return is meaningless. Instead, we are hoping to be in a lucky 10 or 20 year period of phenomenal growth like the 90s.

Good analysis. Now factor in the difference between annual and compound returns, subtract inflation and it’s still a different story.

Gerald

And subtract expenses for owning any stock index (whether transaction or management or both) and you see an even more reduced return. In my opinion mutual funds are the biggest financial scam of the last quarter of a century.

Two things you need to factor in that change the picture:

1. Dividends – during sideways markets money is made in dividends, in fact a very significant portion of stock market returns throughout history have come from the cashflow component (dividends), they’ll make your numbers look much more attractive

2. Dollar cost averaging – the problem with these sorts of illustrations is they assume the person invested in one lump sum, which is of course ridiculous, in practice people invest in chunks over time, sometimes monthly, quarterly, annually, etc. when you factor this in returns get better overall

Management fees are still a very bad idea, as is money churn so I’m not defending high fee mutual funds or transaction fees to churn money.